Business

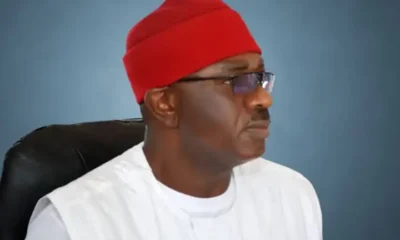

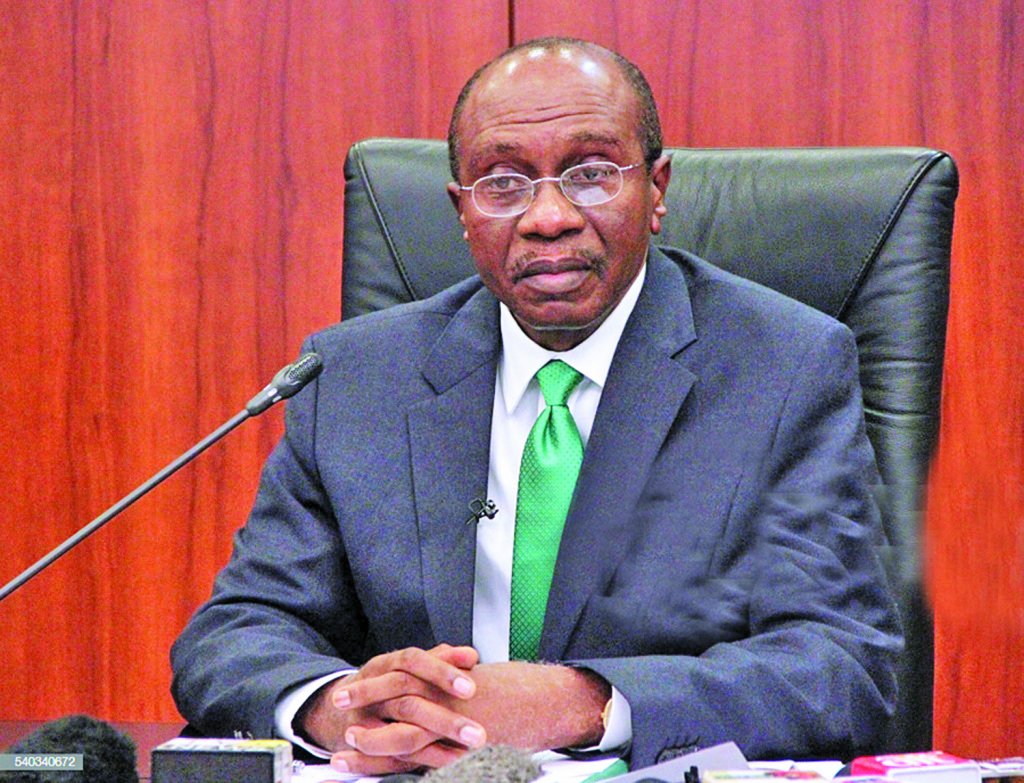

Only 5% Of Cash Transactions Will Be Affected By Cashless Policy – Emefiele

By Emmanuel Aziken with Agency reports

Governor Godwin Emefiele has said that the Central Bank’s implementation of cashless policy in six states of the federation is in public interest to promote efficient payment system. According to him only 5% of cash transactions in the banks will be caught by the new policy.

Emefiele stated these while fielding questions from journalists.

He said that the policy of charging for deposits and withdrawals above the threshold was not new as it was inaugurated in the country in 2012 and implementation began in 2014 while several engagements were held across multiple stakeholders before its commencement.

He said withdrawal charges had been in place since then, only deposit charges were new now to some people though it was part of it from beginning but later withdrawn.

He said: “The policy says if you deposit money in the bank above a particular threshold which for individual is N500,000 and N3 million for corporate bodies, then you will be charged, same for withdrawal.

“It has been like this but after stakeholders engagement, we agreed that it was too early to begin to charge people who want to deposit money in banks.

“We agreed at that time that they were a lot of cash outside the bank industry and there is no need to penalise the people who want to bring in their money to the banks and then we relaxed the essence of charging on deposit.

“We expected that after five years, that is from 2015 to 2019 all cash kept in peoples’ houses should have been brought to the banks.”

He announced that full cashless policy would commence all over the country by March, 2020.

He stated that the policy was not designed to defranchise hard working Nigerians as perceived by some categories of people.

According to him, a data conducted, revealed that close to 95 per cent of cash deposited and withdrawn fall bellow this threshold.

Emefiele said already, Nigerians had embraced electronic channels and online transaction in market places.

He added that Micro, Small and Medium Enterprises now had various options and channels available to them to collect a legitimate payment for good and services, like POS, banks transfer using ATM, USD code among others.

He said that the cashless policy increases transparency in financial dealings and reduce crimes such as ransom payment and extortion among others.

The governor said the bank had the mandate under the CBN Act 2007 as amended to promote a sound and stable financial system through credible efficient payment system.

And For More Nigerian News Visit GWG.NG