Business

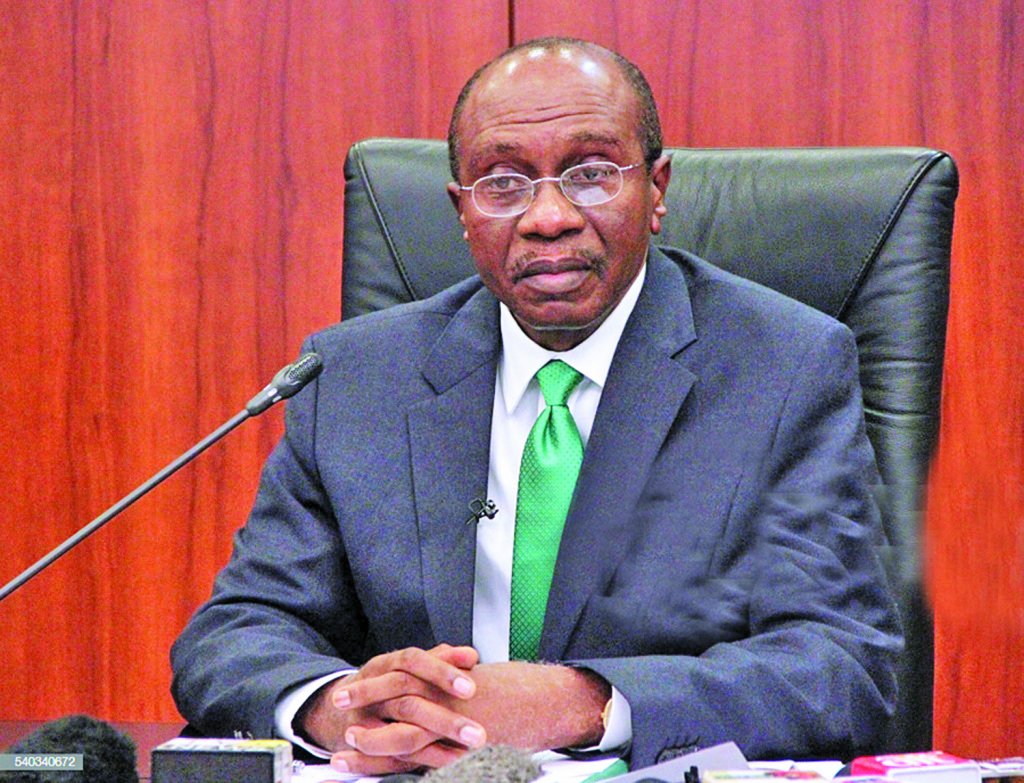

MPC Supports Border Closure – Gov Emefiele

The Monetary Policy Committee (MPC), says it is in support of the Federal Government closure of its land borders.

The Committee according to Governor Godwin Emefiele is also not seriously worried by the drop in the country’s foreign reserve.

Briefing newsmen at the end of the last MPC meeting for the year, 2019, Emefiele said the upward price increase arising from this closure is reactionary and temporary.

Emefiele explained that significant investment had been made in the last three years to sustainably increase domestic food supply.

He said the committee noted some of the key initiatives in this direction to include: the Commodity Development Initiatives, designed to finance the agricultural value chain of 10 commodities namely; Cassava, Cocoa, Cotton, Rice, Tomato, Poultry, Livestock and Dairy, Fish, Oil Palm and Maize.

He added that this had received N171.66 billion in funding while four of these crops received more than N140.12 billion or 81.6 per cent of total disbursements, Cassava, N11.44 billion, Cotton N40.47 billion, Rice N53.40 billion. and Oil palm N34.81 billion.

“It is therefore, expected that the outcome of these interventions will close the supply gaps already envisaged in the medium to long term, including dampening domestic prices.

“It thus, expressed support for the temporal closure of Nigeria’s land borders, noting that securing the country’s land borders should be further enhanced,” he said.

Fielding questions from newsmen, Emefiele advised the government to sustain the border closure for the growth and improvement of the country’s economy.

He said the step taken would gurantee job opportunities and also grow the output and bring Nigerian industries back to life.

On the drop in the Foreign Reserve which recently dipped from about 40 billion dollars to 39.3 billion dollars, the CBN governor said the drop in the reserves was not enough to create fear.

“During the period when we had economic crisis in 2015, 2016 and early 2017 where reserves dropped to 23billion dollars, the country managed it and it survived.

“We do know that there is focus on the fact that crude oil price is not as resilient as it was in 2018.

“We believe that crude oil price today at 63 dollars per barrel, notwithstanding the drop in reserves below 40 dollars should not cause any panic,” he said.

On CBN’s intervention in the foreign exchange market, Emefiele however, noted that the apex bank’s policy of sustaining exchange regime would continue.

“There is no where you are going to find the hand of CBN intervening in the determination of the exchange rate.

“It is not the right statement for anyone to say that there is peg on the naira.

“Investors and exporters windows trade at market, as you know that the price at that market is not fixed, the price varies from N359 sometimes trade upward as high as N364.

“And as more inflow comes into the market, the price trade downwards. To say there is peg in naira is misleading,” he explained.

The governor however, said the only way the bank intervened in the market was either to buy dollars if the rate was low at level where the bank felt it wanted to buy.

According to him, engaging in this did not amount to a peg as it is insinuated by some people.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG