Business

CBN Hedges Against Inflation With Increased CRR

By Emmanuel Aziken, Editor

The Monetary Policy Committee (MPC) of the Central Bank has increased Cash Reserve Ratio (CRR) from 22.5 percent to 27.5 percent but kept all other key rates at prevailing levels.

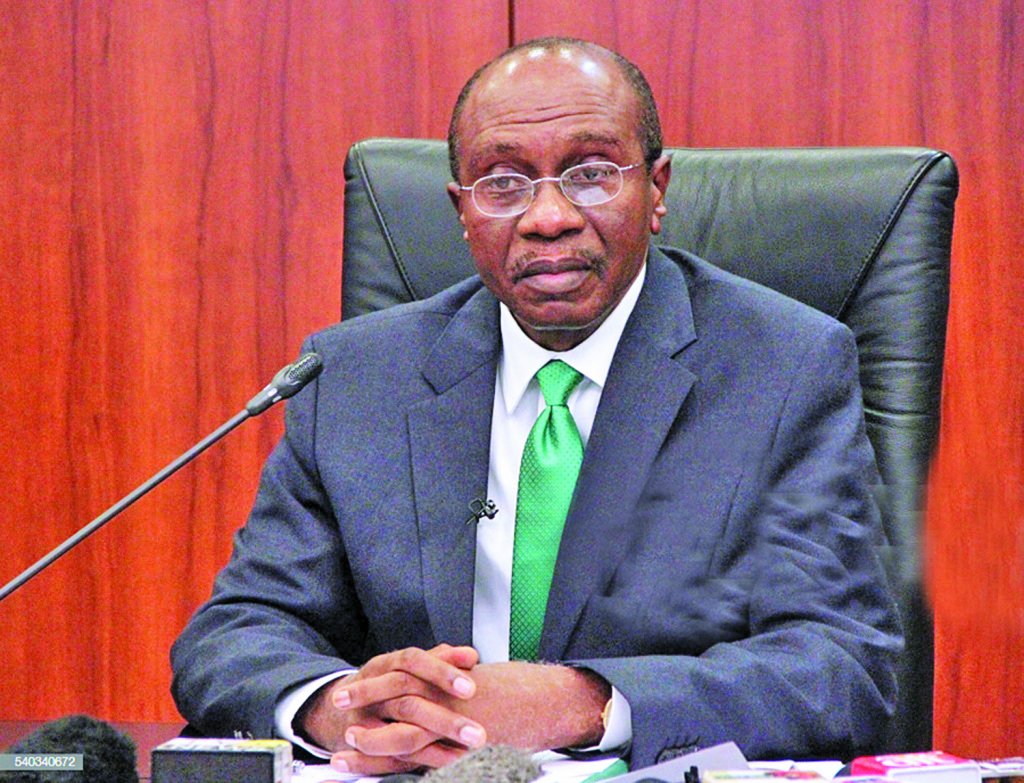

Governor Godwin Emefiele, the nation’s number one banker disclosed this as he read the communiqué of the MPC meeting that ended on Friday afternoon.

The CRR is the proportion of a bank’s liquid cash that is compulsorily kept with the apex bank. The apex bank is able to influence liquidity in the system using the ratio.

The decision of the MPC to raise the CRR by a significant 5 percent could be interpreted as a way of stemming inflation that would have followed the CBN’s earlier directive increasing the Loan to Deposit Ratio, LDR to 65%.

However, while all 11 of the MPC members attended the meeting Governor Emefiele disclosed that the decision to increase the CRR was not unanimous. He said that nine of the members agreed with the decision to increase the CRR.

The Monetary Policy Rate (MPR) was retained at 13.5 per cent meaning that loans and interest rates would not be significantly affected because the MPR is the rate at which the Apex bank lends to the banks which in turn influences all other rates in the system.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG