Business

The Access Bank Story: How Two Young Men Took A Dying Bank To The Top

By Etim Etim

A chronicle of courage, inspiration, success and audacity and one of the most fascinating success stories of our time. It is an outstanding work and one of the most engaging volumes I have read in recent years. It’s captivating reading which provides invaluable insights for anyone planning to invest in Nigeria, and indeed Africa. Written with stunning honesty about the setbacks as well as the triumphs

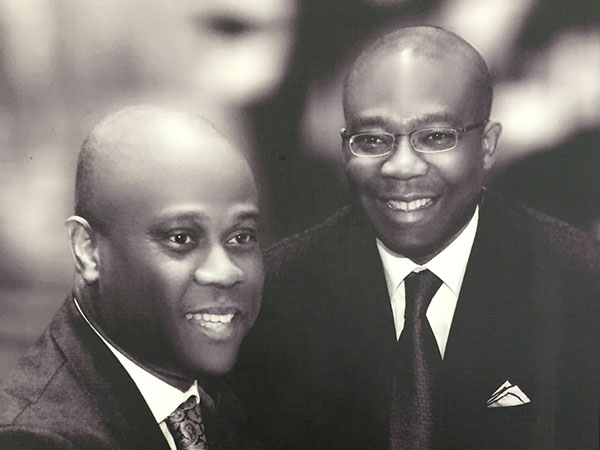

The story of Access Bank is one Nigeria has been waiting to hear for a long time. A chronicle of courage, inspiration, success and audacity, it is one of the most fascinating success stories of our time which chronicles how Aigboje Aig-Imoukhuede and his partner, Herbert Wigwe bought a crisis-ridden and dying bank, and turned it into one of the nation’s strongest and biggest.

I am glad that the account is given by the lead character in the epic event. It is an insider’s reminiscences, written in elevated language and replete with important details. Aig-Imoukhuede’s soon-to-be-published new book gives detailed narration and recollections of how the two friends launched a hostile takeover of the bank in 2002 and executed the most aggressive growth strategy in the industry which catapulted the collapsing institution from the bottom to the top.

Titled Leaving the Tarmac: Buying a Bank in Africa – a title adapted from his childhood experience in Kaduna – the 208-page volume is beautifully written in an elegant business prose, but bereft of the arcane phraseology of finance people. Sequentially, Aig presents the exciting and sad episodes of his 13-year tenure as the CEO of the bank, starting with how the dream to buy a bank came about and ending with the epochal acquisition of Intercontinental Bank in 2011.

The book had been ready since 2015, a year plus after his retirement from the bank. I got wind of it about the middle of last year, and in early January 2021, I received an advance copy from the author and quickly tore through it in a day and half. It is an outstanding work and one of the most engaging volumes I have read in recent years.

Leaving the Tarmac gives a detailed blueprint for creating a sustainable business founded on excellence; gives direction on how to build and lead a winning team and suggests guidelines on how to operate successfully in emerging markets. To describe it as a financial thriller is quite apposite, and I can just expect that our movie producers will soon be talking to Aig and his publisher.

As a former staff member of the bank (June 2008 – February 2013), I read the book with fond memories. I recalled how I soaked up the passion, energy and drive with which these two men paced through all sorts of obstacles to fulfill their big dream. And that dream was set from day one: they wanted to become one of the biggest ten banks in just five years.

It is in Access Bank that I saw the old adage we learned in primary school, ‘’Determination is the key to success’’ walk on two legs. Every Access person, including the janitor, was just pursuing the dream. It is for nothing else that Access Bank staffers refer to themselves as Access Warriors. I commend Aigboje on this piece of work and hope that it would inspire more business leaders to publish their experiences.

Chapter One, titled Entrepreneurial Juice, outlines the genesis of the author’s banking career and gives a brief account of the evolution of Nigeria’s banking industry. He began his career in 1988, just two years after the then military Head of State, General Ibrahim Babangingda, launched his Structural Adjustment Programme (SAP), the IMF-inspired economic restructuring which fostered the liberalisation of the banking industry, among many other initiatives.

Aig worked in two banks in quick succession during which period he met and struck what appears to be a life-long friendship with Herbert in 1989, and together they joined GTB in 1991. At GT Aig came in close contact with Fola Adeola, its founder and first CEO who turned out to be Aig’s mentor and one of the greatest influences in his life.

At meetings in Access Bank, Aig would often mention Fola and Sir Alex Ferguson in glowing terms, either to illustrate a point or inspire us. He will then veer off to praise the performance of Manchester United, his favorite team. I remember one day at a meeting Aig announced out of the blue: Do you know that Man U will always score a goal in the last 10 minutes of every game? The roof nearly came down with laughter as nobody had expected that.

In Leaving the Tarmac, Aig presents Adeola as one of his heroes and pays tribute to him for offering him the best opportunities available then, including taking him to meetings with President Olusegun Obasanjo and other senior government officials. It was at those meetings that Aig picked up signals on the direction of government policies and the urge to own his own bank began to grow bigger and bigger.

Although the dream of owning and managing his own bank might have been fermenting in his mind, it was while he was attending an Executive Management Programme at Harvard Business School towards the end of 2000 that the full realisation of his dream crystallized in his brain. The narration is compelling and lucid. Among the several books I’ve read lately, Leaving the Tarmac is one of the most gripping.

In Chapter Two, titled Buying the Bank, the author details out the planning, hard work and intrigues that went into acquiring Access. The reader is led into the reasons why he and Herbert chose to buy Access among the lot they shortlisted and considered, how much it cost, how they raised the money, the regulatory issues they faced and how Fola Adeola and the management of GTB reacted when they got wind of their secret plans.

When this transaction was being consummated, I was already a manager in one of the merchant banks that had just transited into a universal bank, and like many others in the industry, I had also picked up the rumour of the acquisition, but little did we know that the seed would grow into a big Iroko. Aig writes with candour, openness and an apparent intention to inspire and teach the younger generation to dream and dare.

He ensures that the book is detailed but not flippant. He does not dwell on innuendoes, personalities and scandals. The book reminds me of Jack Welch’s memoir, Straight From the Gut. The author reveals the unexpected push backs from the directors, management and staff of Access Bank as he was getting set to take possession of the bank, explaining in detail what they did to overcome the resistance. He writes: ‘’Unsolicited acquisitions were not understood and were viewed with great suspicion and apprehension’’. Although he left GTB on a very sad note after his bosses had found out that they were working on buying a bank, it is to the credit of Aig’s big and generous heart that he has not been holding grudges as we often see in politics.

On March 22, 2002, Aig and Herbert, then only 36 (both were born in the same year, just one month within each other), began work at Access Bank, their new place of employment located at Oyin Jolayemi Street, Victoria Island, as managing director and deputy managing director. The new office was only five buildings from the head office of GTB. From there they designed and implemented the new business model of their new bank.

Chapters 4 and 5 explain this model in detail, in addition to other challenges like staff and staffing problems, relationship with the regulators and how he handled the ethical failings of the previous management. The author also discusses the intrigues and intricacies of the bank’s board meeting of March 21 during which their appointments were formally approved. The board meeting lasted a grueling 12 hours, but it was in the last hour that Aig, supported by Herbert, rose to defend his mission.

He recalls: ‘The decision as to whether or not to appoint us came down to the Enterprise Transformation Agenda that we shared with the Board, the key highlights of which was our plan to take Access Bank from the 70th position to rank amongst Nigeria’s top 10 banks in five years’’. It is in this chapter that the reader will grasp the full essence of the emotional intelligence and energy with which he pursued his vision in the 13 years he spent in Access Bank.

The bitter experience of a plane leaving him behind at Kaduna airport tarmac as a young school boy which is well told earlier in the book is so seared into his persona that he had vowed that no obstacle would ever debar him from achieving his dream.

This book should be read by every former and current staff of the bank. They will better understand the reason behind all those weekend work, marathon strategy sessions, nightlong meetings, big targets, etc. Aig gives credit to Gbenga Oyebode, their lawyer, for providing the legal arsenal during the board meeting and Cosmas Maduka, the bank’s director who was very sympathetic to them before and during the meeting. Oyebode was to later become the Board Chairman of the bank, while Maduka has been serving as a board member since then. The book is however silent on why the new investors did not consider a name change for the bank as part of the total transformation.

In this book, the author carefully documents his legacy in the industry. He comes through as a strong and determined leader well cultured in corporate governance and management. One of his legacies is Access Bank’s School of Banking Excellence. The author writes in detail on the roles of the bank’s training school in identifying and training young fresh university graduates to mould the character and personality of the new recruits in line with the bank’s corporate standards. The programme entails a four-month entry-level programme in which participants must do 15 exams and must score at least 65% in every one of those exams, otherwise they don’t graduate. The School has been so successful in grooming young talent that as at 2014, about 2,000 have graduated from the school and gone on to work in the bank, half of whom are still working in the bank as at today.

Aig explains that it costs the bank N2 million to train each person. In my five-year career in the bank, I worked with six of them, and found them unbelievably smart, smart and competent. I strongly recommend such a training school for Nigeria’s political and leadership class.

There are many other enchanting sections in the book among its 17 chapters. Chapters Nine (Raising Twenty-Five Billion) and 14 (A Significant Acquisition) narrate how the bank raised N25 billion to meet the regulatory deadline of December 31 2005 and the landmines that lay in wait in the process of buying Intercontinental Bank.

The author gives vivid recollections of the various problems that beset the two transactions at every stage and how the challenges were addressed methodically. Overcoming the Soludo N25 billion challenge was so excruciating that Aig nearly lost his life in the process. He recalls in the book how he collapsed sometime in 2005 and had to be airlifted abroad for treatment.

But the purchase of Intercontinental in 2012 after a rigorous process that lasted two years and three months was perhaps the crowning glory of his 25-year career. That’s when the bank finally arrived at the coveted top 5 position where it rubs shoulders with Zenith, UBA, First Bank and GTB. Yes, GTB, the very institution that provided the launch pad from which he took off.

This book is a very captivating reading which provides invaluable insights for anyone planning to invest in Nigeria, and indeed Africa. It is well written, serious and sober. Aig ensures that he does not stir up controversy or offend banking codes; so many names are not mentioned. But the book is not an autobiography, so I can understand why some areas were left unmentioned. However, there are many questions I would have liked it to address. For example, how has he been able to keep his relationship with Herbert for so long? How did they handle envy in the industry and elsewhere as their success was rising? The author has written with stunning honesty about the setbacks as well as the triumphs they faced. I recommend the book to every business school in the country and continent and all the departments of business and banking and finance in our universities.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG