Opinion

Why Wale Edun’s New Job Is Puzzling

By Etim Etim

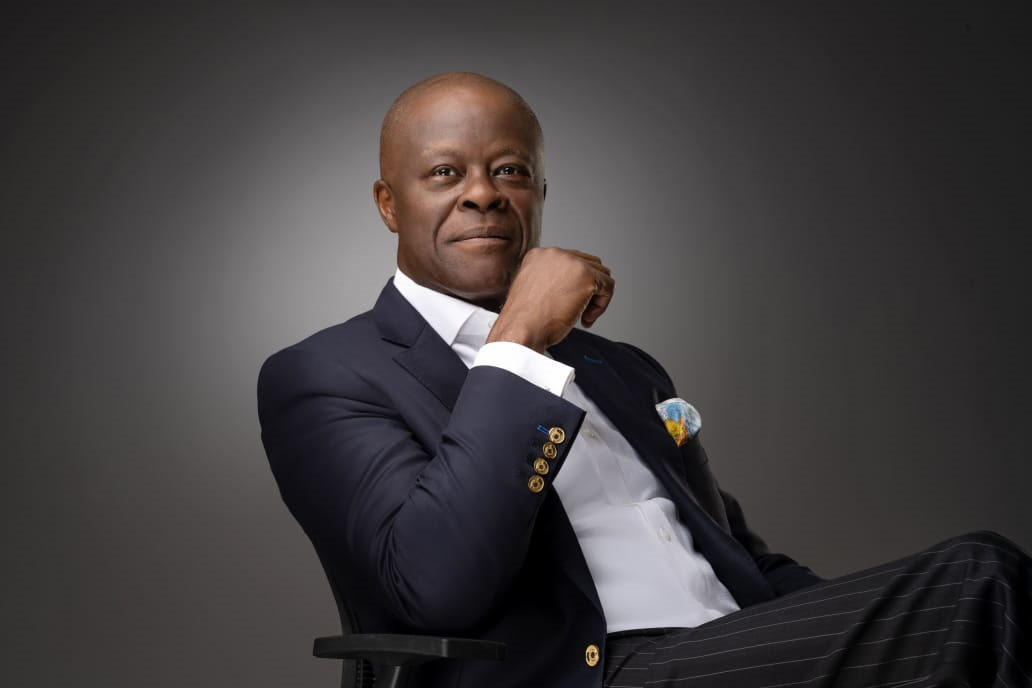

The appointment of Mr. Olawale Edun, a seasoned investment banker and former commissioner of finance in Lagos State, as the Special Adviser to the President on Monetary Policy, has set off torrents of speculations on what exactly would be his job description given that monetary policy is statutorily an exclusive responsibility of central banks all over the world.

In a rare unanimity, many economists I have spoken to agree that the appointment is an aberration that could erode the hard-worn independence of the CBN, and create some conflict between the Presidency and the monetary authority.

Monetary policy is a set of tools used by a nation’s central bank to control the overall money supply, interest rates and bank reserve requirements in order to tame inflation and promote economic growth. In other words, monetary policy seeks to achieve price stability in the economy. It is a function specifically assigned to one of the four deputy governors of CBN. It’s the core job of all central banks.

To effectively perform this function, the CBN has since 2005 constituted a Monetary Policy Committee (MPC), which is the highest policy-making committee of the Bank with a mandate to meet regularly and review economic and financial conditions in the economy and determine appropriate action plans in the short to medium term.

It also regularly reviews the CBN Monetary Policy framework and adopt changes when necessary. MPC is chaired by the Governor, and is made up of the four deputy governors and a few other distinguished economists and eminent persons with strong financial backgrounds.

In Nigeria, the MPC meets every two months and its decisions are communicated to the public over time, the membership of MPC has been expanded to include the Head of the African Development Bank (ADB) Office in Abuja; Securities & Exchange Commission (SEC) and Permanent Secretary, Federal Ministry of Finance. The Presidency is also represented in MPC.

Under Buhari, it was Mohammed Salisu, SSA to the President on Development Policy who represented the Presidency on MPC. Edun will now take his place in this very important Committee.

But a membership of MPC that meets six times in a year could not be the only duty of a cabinet-level official. What else would be Edun’s specific duties in the area of monetary policy? Some economists are puzzled by the designation and they think that implies a possible encroachment on the independence of the CBN. ‘’I do not understand the significance of the appointment, and I’m worried that the new administration might be straying into unfamiliar territory’’, says Horgan Akpan Ekpo, a professor of economics, who had once served as a member of the Board of Directors of the CBN and a member of its MPC (Monetary Policy Committee) during the tenure of Prof. Charles Soludo as CBN Governor. Speaking to this writer exclusively, Ekpo notes that although Mr. Godwin Emefiele might have made some mistakes in the manner he ran the Bank, it is not enough reason for the government to seek to interfere in its core functions. ‘’The CBN Act confers enormous independence on the Bank for good reasons.

It is a big progress from the days when the Bank was a parastatal of the Ministry of Finance; so, it would be a serious retrogression for us to do anything that would take us backwards’’, Ekpo, a former vice chancellor of University of Uyo, said. Ekpo had also been the chief executive of West African Institute for Financial and Economic Management (WAIFEM), a training institution co-owned by the Central banks of the Anglophone West African countries.

While the CBN handles the monetary policy, the Ministry of Finance is responsible for fiscal policy which basically entails taxation and spending. Both sides are independent of one another but they work in harmony for the good of economy. Which explains why people are trying to figure out what Edun’s job entails.

‘’I suspect that his responsibility would be essentially to watch over the CBN Governor on behalf of the President, and to ensure that the Bank takes orders from the Villa,’’ says a financial consultant who has had a long career spanning banking and insurance, is close to the new power brokers but does not want his name mentioned in this article. He believes that the President will like to have a total control of what happens in the economy, and so he wants a trusted ally to watch over the new CBN governor that will replace Emefiele.

He says: ‘’Emefiele was very close to President Buhari. He could walk into the Villa at any time and see President Buhari at short notice.

But in this era, Tinubu may not need direct interaction with the governor, and so, it is Edun that would be an intermediary between the Villa and the CBN’’. But since there is National Economic Council (NEC) and the President may appoint an Economic Adviser and/or Economic Management Team, this anonymous consultant believes that Edun’s role as Monetary Policy Adviser appears suspect, or at best otiose.

Another economist and banker, Marcel Okeke says the appointment is an aberration as Edun may be working in conflict with the law establishing the CBN. ‘’Mr. Edun is an accomplished banker and a thoroughbred professional, but he cannot take over the duty of the CBN. By the CBN Act 2007, monetary policy matters are the sole responsibility of the CBN’’, Okeke, who was also one of the influential finance journalists in the 1980s, said.

He notes that even the judgement of the Supreme Court on the issuance of the new Naira notes by the CBN last year was an anomaly since ‘’monetary matters should not be decided by the Supreme Court but by the CBN’’. This is the same line of thought that Johnson Chukwu, Group Chief Executive Cowry Asset Management Group expressed in an interview on Arise News the other night. He said Edun’s job title is a misnomer since ‘’monetary policy is an exclusivity of the CBN’’.

Former Deputy Governor of the CBN, Prof Kingsley Moghalu, refused to make a comment when I contacted him. I was surprised at his reticence because Moghalu is naturally vocal matters of public policy and public interest. However, in a statement he issued last September on the need to maintain the independence of the CBN, Moghalu had argued against a proposed bill presented at the National Assembly that sought to abridge the Bank’s independence.

‘’Such amendment to the CBN Act of 2007 would finally destroy the institution by disrobing it completely of its institutional independence as enshrined in the Act. It would make the Bank, a statutory corporation under the law, to become a ministry or a mere agency or department of government; and it would render the bank an open playground for politicians who are the custodians of our dysfunctional governance’’, he wrote.

I had initially thought that Edun would be the new finance minister. He fits the bill by all standards. I was therefore equally surprised at his designation as Adviser on Monetary policy. First of all, it is not the job of the President to fix interest rates or manage money supply (M1 and M2).

That is the duty of the CBN; and the CBN Governor is also the chief adviser to the government on such matters. However, the President has the right to seek a second opinion in addition to that of the CBN. The position could also be a subtle hint that Edun is being prepped to take over as the new CBN Governor. Afterall, Prof Soludo was first made chief economic adviser to the President before he was appointed Governor some 20 years ago.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG