Business

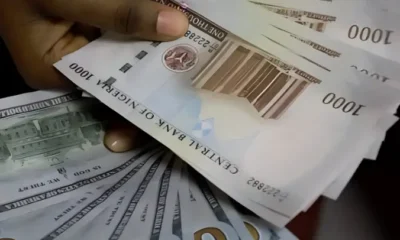

Naira Struggles In Black Market, Despite Successful $2.2B Eurobond Sale

The Nigerian Naira remained largely stable in the unofficial market on Wednesday, trading around N1,750/$ despite improvements in the country’s foreign exchange market.

Despite the Central Bank of Nigeria’s recent decision to raise interest rates, the Naira continues to face significant pressure in the market.

In the unofficial market, traders maintained control over the N1,725 support level, indicating that short sellers remain dominant. The Naira’s struggles persist even though the country’s foreign exchange reserves have reached multi-month highs, surpassing $40 billion for the first time in over two years.

Despite these positive indicators, the Naira was largely unmoved by Nigeria’s successful Eurobond issuance of $2.2 billion. This was the first such sale in over two years, and it received substantial investor interest. The bond raised funds through the 2031 and 2034 maturities, with coupon and re-offer yields of 9.625% and 10.375%, respectively. “This result demonstrates the resilience of Nigerian credit and the growing confidence of investors,” stated Olayemi Cardoso, Governor of the Central Bank of Nigeria. He added that the funds raised would be used to support the government’s budget and finance the fiscal deficit for 2024.

The Central Bank of Nigeria is also introducing an electronic FX matching system to enhance market transparency. This system, which has been effective in other markets, aims to stabilize the Naira and improve the foreign exchange market’s functionality.

While there are positive signs, such as the Naira’s apparent stabilization due to recent policy measures, global rating firm Fitch Ratings has cautioned that the market has not yet fully stabilized.

The International Monetary Fund (IMF), however, reports that the Naira is showing signs of stability due to actions like the interest rate hikes and the clearing of overdue foreign exchange obligations. “Policy actions by local authorities have resulted in positive developments; in Nigeria, rate hikes and the clearing of overdue obligations have helped the Naira show more signs of stability,” the IMF noted.

The outlook for the Naira remains mixed, with ongoing challenges despite efforts by the Central Bank to stabilize the currency.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG