National

How Nine Niger Delta States Shared N625 Billion – Presidency

Presidency says nine oil-producing states from the Niger Delta have so far received a total of N625.43 billion 13 percent oil derivation, subsidy and SURE-P refunds from the Federation Account between 1999 and 2021.

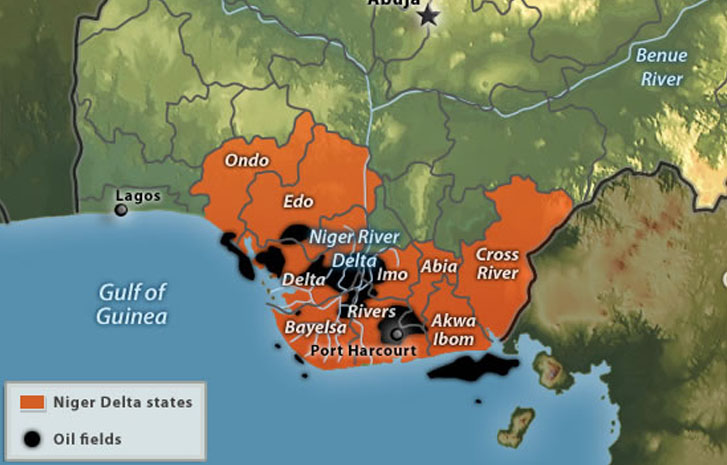

According to a statement on Friday in Abuja by Malam Garba Shehu, the president’s media aide, the affected states that received the refunds dating from 1999 to 2021 were: Abia, Akwa-Ibom, Bayelsa, Cross River, Delta, Edo, Imo, Ondo and Rivers.

Shehu quoted data obtained from the Federation Account Department, Office of the Accountant General of the Federation as showing that a total of N477.2 billion was released to the nine states as refund of the 13 per cent derivation fund on withdrawal from Excess Crude Account (ECA)

This, he said, was without deducting derivation from 2004 to 2019, leaving an outstanding balance of N287.04 billion.

He said the states also got N64.8 billion as refund of the 13 per cent derivation fund on deductions made by NNPC without payment of derivation to oil producing states from 1999 to date.

According to him, the benefitting states still have an outstanding balance of N860.59 billion windfall from the refunds, which was approved by President Muhammadu Buhari.

According to the figures, under the 13 per cent derivation fund on withdrawal from ECA without deducting derivation from 2004 to 2019,

He said: ”Abia received N4.8 billion with an outstanding sum of N2.8 billion, Akwa-Ibom received N128 billion with an outstanding sum of N77 billion, Bayelsa with N92.2bn, leaving an outstanding sum of N55 billion.

”Cross River got a refund N1.3 billion with a balance N792 million, Delta received N110 billion, leaving a balance of N66.2 billion, Edo received N11.3billion, with a balance of N6.8billion, Imo, N5.5 billion, with an outstanding sum of N3.3 billion and Ondo State, N19.4 billion with an outstanding sum of N11.7bn.”

Shehu added that Rivers was paid 103.6 billion, with an outstanding balance of N62.3 billion.

The presidential aide stated that the affected states were paid in eight installments between Oct. 2, 2021 and Jan. 11, 2022, while the ninth to twelfth installments are still outstanding.

On the 13 per cent derivation fund on deductions made by NNPC without payment of derivation, Shehu said the nine oil producing states in the Niger Delta were paid in three instalments this year, with the remaining 17 instalments outstanding.

‘He said: ‘Under this category, Abia received N1.1 billion, Akwa-Ibom, N15 billion, Bayelsa, N11.6 billion, Cross River, N432 million, Delta State, N14.8 billion, Edo State, N2.2 billion, Imo State, N2.9, billion, Ondo State, N3.7 billion, and Rivers State, N12.8 billion.”

Meanwhile, Shehu revealed that the benefitting states shared N9.2billion in three installments in April, August and Nov. as refunds on the 13 per cent derivation exchange rate differential on withdrawal from the ECA.

The three largest benefitting states were Akwa Ibom (N1.6billion), Delta State (N1.4billion) and Rivers (N1.32billion).

”Similarly, all the nine states received N4.7 billion each, totalling N42.34 billion as refunds on withdrawals for subsidy and SURE-P from 2009 to 2015.

”The refund, which is for all the states and local government councils, was paid on Nov. 10, 2022.

”The Federation Account also paid N3.52billion each as refund to local government councils on withdrawals for subsidy and SURE-P from 2009 to 2015 on the same date in November,” he added.

According to Shehu, Buhari considered it a matter of honour and decency that debts owed to states or anyone for that matter be repaid, and in time without regards to their partisan political affiliations.

”The president will continue to render equal service to all the states of the federation and an acknowledgment of this by Gov. Nyesom Wike of Rivers State and the others was not out of place.

”The refunds to the oil producing states will continue,” Shehu further assured. (NAN)

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG