Business

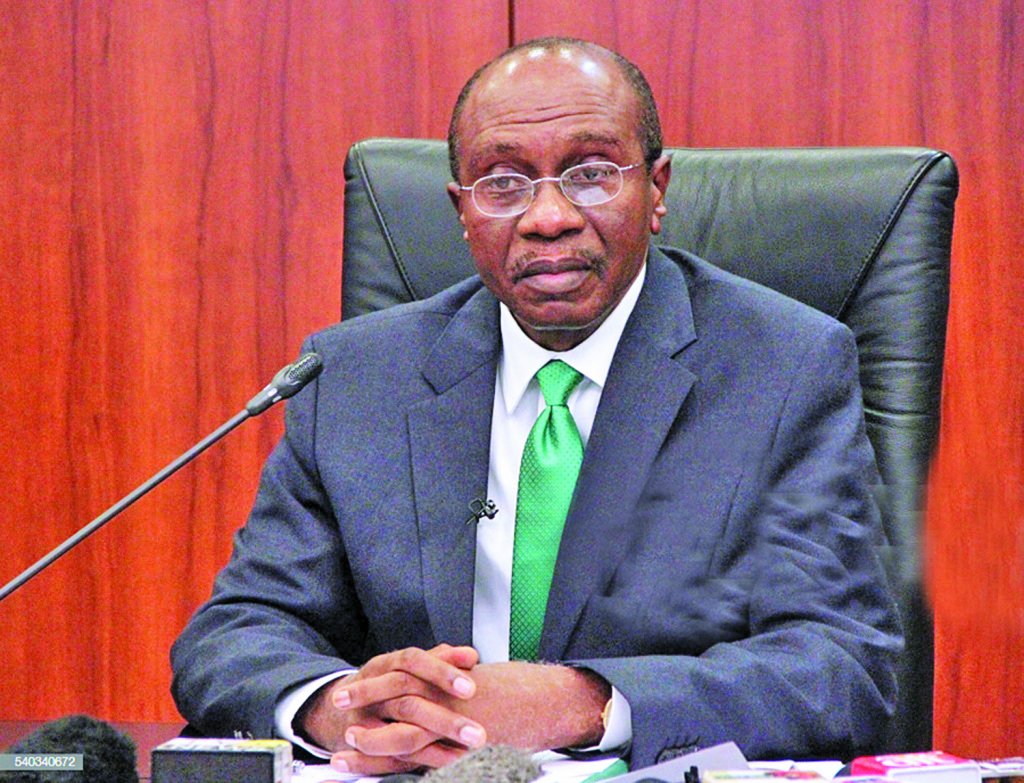

As MPC Meets: Unusual Challenge Gov Emefiele Must Tackle

By Emmanuel Aziken, Editor

With year to date surge of Nigeria’s equities market reputed to be among the highest in the world (10.3% last Friday), the Nigerian stock market is being said to be among the best performing in the world.

So would Governor Godwin Emefiele nudge the Monetary Policy Committee towards adjusting rates in any direction?

That is the multi trillion naira question ahead of Thursday’s first MPC meeting of the year.

At the last meeting in November 2019 and with pressures on inflation mostly coming from the increase in the Minimum Wage and the closure of the country’s borders, the MPC held interest rates. But at that time Nigeria’s equities market was being compared to among the worst performing in the world.

However, the seasonal bounce in the equities market has momentarily shifted focus from the fixed income securities towards equities on account of expected dividend windfall by some of the major companies.

Observers as such believe that the New Year bounce of the equities market remains what it is a bounce that will sooner that later tail off.

Again given the fact that the country’s inflation rate (11.98 December, 2019) is well above the rate for the Treasury Bills rate, those pursuing higher returns would be expected to dive for the equities market.

Against this background of momentary pleasure, analysts believe that it is doubtful that the MPC would adjust the market rates.

The global economic situation as it affects Nigeria is largely unchanged.

However, what could be a game changer is the unusual release of Federal Government capital funds at this time of the year.

Since the advent of the Fourth Republic Year 2020 is about the second time that the budget cycle has commenced from January.

With the Federal Government opening the treasury for capital expenses, it is expected that not only Federal Government funds, but even private sector expenditure that are triggered by public sector expenditure would be activated.

How these forces bounce to affect the economy is an issue that this week’s MPC meeting will likely take into consideration in its decisions.

However, GWG foresees the MPC holding all rates till its next meeting in March.

The meeting will also be an opportunity for the committee to review the new year charge regime slapped on the unwilling banks by Governor Emefiele.

While the charges have been generally welcomed by bank customers, banks which have profited and made good money from the idle transactions will have an opportunity to pass on their feelings to the Central Bank.

President Muhammadu Buhari with his seeming unwillingness to buckle to international pressure as most recently expressed by President Kofi Addo of Ghana to open the borders and with his ability to nudge the National Assembly to pass the budget well ahead of the beginning of the financial year, the CBN is faced with an unusual challenge of monetary and capital market forces.

How the MPC from its privileged position resolves the issues will be communicated to the markets on Friday.

And For More Nigerian News Visit GWG.NG