Business

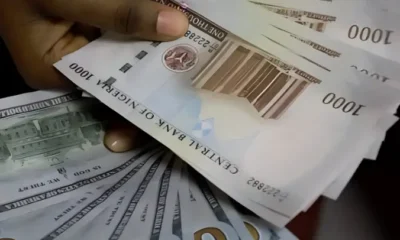

Naira Continues Free Fall As NNPC’s Bid For $3bn Loan Drags

There are growing concerns that the much celebrated $3 billion emergency loan from the African Export-Import Bank to stabilise the country’s volatile foreign exchange market by the Nigerian National Petroleum Company Limited (NNPC) is footdragging, leading to the continuous free fall of the Naira to the dollar.

Daily Trust findings show that the Central Bank of Nigeria (CBN) gross reserves have not seen any increase, and are down 0.2% to $33.68 billion since the announcement was made on August 16.

The announcement two weeks ago was embraced as a relief in the forex market, as the naira appreciated at both the official Investors’ and Exporters’ (I&E) forex window and the parallel market.

A significant upswing was observed in the parallel market as the nation’s currency strengthened from N940/$1 the previous day, to N880/$1, reflecting a substantial increase of N60. On the other hand, at the official I&E window, the nation started off with an opening rate of N774/$1 but appreciated to N759/$1 at the close of the market following the announcement.

New findings by Daily Trust have suggested that the $3 billion crude repayment loan is dragging because other lenders that were supposed to be a part of the syndicated transaction are said to have backed out, a source revealed.

The source said: “Afrexim was supposed to put down only $250 million which was to help bring on board other lenders who are already heavily exposed to Nigeria and have obligor limits.”

The West African region already accounted for 45% of loans from the Afrexim Bank as of the first quarter of 2023, according to data from its financials.

There is no mention of the deal on Afrexim Bank’s website, a search by Daily Trust also revealed.

Daily Trust mail to Afrexim press to be furnished with the details of the transaction was not responded to by the institution.

Another mail to the Afrexim press office to confirm or debunk the alleged stalled transaction was also not responded to as at press time yesterday.

However, a management source at the NNPCL in a short response to the Daily Trust inquiry said: “Discussions are still ongoing”

Meanwhile, the naira continued to weaken against the US dollar on the official foreign exchange as the naira opened at 769.66 to $1 and closed at N775.34 to $1 on Tuesday.

A robust demand for the dollar kept the naira on a decline as it exchanged for 920–925 naira to $1 in the black market. Dealers acquire from willing sellers at N/$915 and sell to willing sellers at N/$920-925.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG