Business

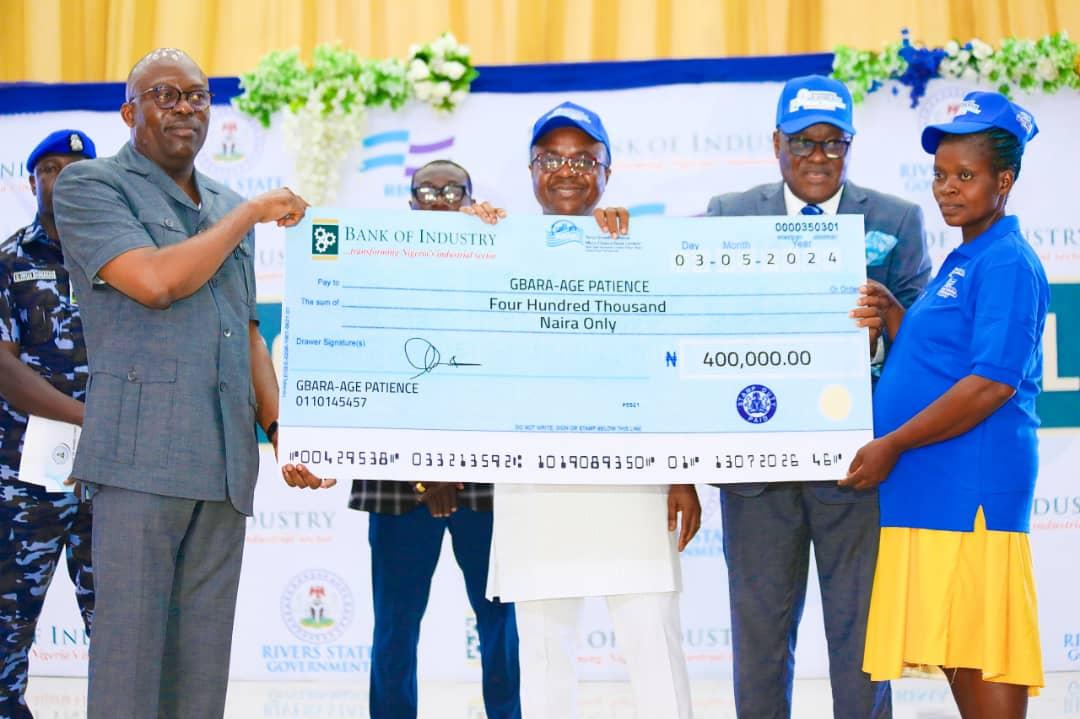

Fubara Empowers 3,066 MSMEs With N4b Soft Loan

Rivers State Governor, Sir Siminalayi Fubara, has formally launched the N4bn matching fund loan scheme expected to stimulate business activities in the State while also creating wealth through .

The launching, which took place at the Dr Obi Wali International Conference Centre in Port Harcourt on Friday, signaled the commencement of the disbursement of Rivers State Government/Bank of Industry (BOI) Limited N4billion marching fund loan scheme for nano, small and medium-scale businesses in the State.

Governor Fubara said the lack of access to credit had continued to aggravate financial exclusion and choked the prospects for individuals to realise their economic aspirations for a better life.

But with the scheme, which is a partnership between Rivers State Government and BOI, now launched, Governor Fubara emphasised that a surest path has been secured to achieve entrepreneurial success while serving as an enabler of economic prosperity in the State.

Governor Fubara explained that as a campaign blueprint, he promised, during his electioneering campaigns, to support entrepreneurial development and the growth of businesses through access to credit in the form of soft loans.

The Governor said, upon assumption of office, he noticed more closely how most businesses, especially those of small scale, struggled and either died or gasped in accessing credit that were only offered by banks at neck-breaking interest without success.

Governor Fubara pointed out that: “As a State, we cannot talk about economic growth without stimulating business activities to create wealth and jobs through policies and programmes that will engender greater public access to credit and financial inclusion.

“MSMEs are well-known as critical drivers of inclusive economic growth and development. By empowering our people to cultivate available economic opportunities, access to credit is a powerful tool for achieving financial security.

The Governor, therefore, instructed the management of the Rivers State Microfinance Agency (RIMA) to monitor the progress of the beneficiaries in their businesses and ensure a 100 percent recovery of the loans to guarantee the sustainability of the programme.

Governor Fubara noted the gains of the symbiotic economic partnership between the State Government and BOI, and the transformed commitment to further strengthen and cultivate it for the benefit of the people of Rivers State.

In his address, the Managing Director/Chief Executive Officer of Bank of Industry (BOI) Limited, Dr Olasupo Olusi, represented by the Executive Director of Corporate Services and Commerical, Mr Usen Effiong, said they were particularly interested in ensuring that the collaboration is realised in steering socio-economic growth, creating jobs, checkmating social vices and growing the IGR of Rivers State.

Delivering his welcome address, the Managing Director and Chief Executive Officer of Rivers State Microfinance Agency (RIMA), Pastor Jonathan Tobin, said it was exciting that they were given the opportunity to contribute to achieving the dream project of Governor Fubara christened, “Touching Lives, Creating Wealth.”

Pastor Tobin stated that the timing of the launching of the scheme is auspicious because it was coming when the operating capital of most businesses have been eroded.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG