Lifestyle

How To Budget Your Income On A Yearly Basis

By Benjamin Abioye

Managing your money for the entire year can seem tricky, but it doesn’t have to be! With a good plan, you can save money, avoid debt, and reach your financial goals. Here’s an easy and fun guide to creating a yearly budget.

Step 1: Figure Out Your Total Income

First things first, how much money do you make in a year? This includes your salary, bonuses, side jobs, and any other cash you get. If your income changes each month, try to estimate an average amount that’s a bit on the low side to be safe.

Step 2: Track Your Spending

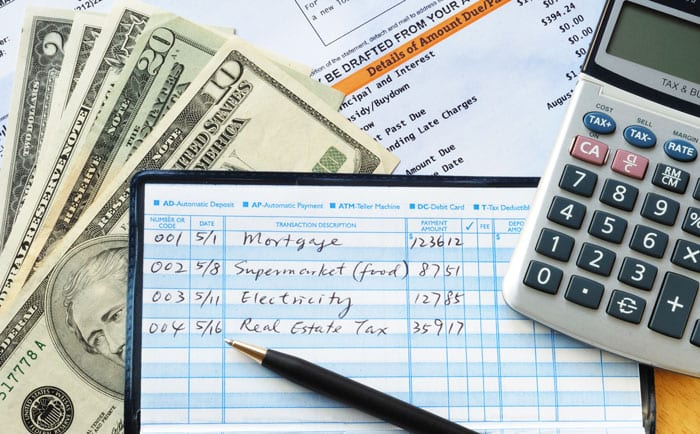

To budget well, you need to know where your money goes. Write down everything you spend money on, like rent, groceries, bills, and fun stuff like movies or eating out. Look at your bank statements from the past year to see your spending habits. Using a budgeting app or a simple spreadsheet can help keep things organized.

Step 3: Set Your Financial Goals

What do you want to achieve with your money? Short-term goals might include saving for a trip, paying off a credit card, or building an emergency fund. Long-term goals could be buying a house, saving for retirement, or funding your kids’ education. Having clear goals helps you stay motivated and focused.

Step 4: Make a Spending Plan

Now that you know your income and expenses, create a plan for your money. Start with the essentials like housing, food, transportation, and bills. Then, allocate money for your financial goals like savings and debt repayment. Lastly, set aside some funds for fun activities, making sure you don’t overspend.

Step 5: Build an Emergency Fund

An emergency fund is your safety net. Aim to save enough to cover three to six months of living expenses. This fund helps you handle unexpected costs like medical bills, car repairs, or losing your job. Regularly putting money into this fund can save you from financial stress.

Step 6: Check and Adjust Your Budget

A budget isn’t set in stone. Check it every month to see how you’re doing. Compare what you planned to spend with what you actually spent and make adjustments as needed. If you’re spending too much in one area, find ways to cut back.

Step 7: Cut Unnecessary Expenses

Find areas where you can save money. Maybe you can eat out less, cancel subscriptions you don’t use, or shop for cheaper alternatives. Small changes can add up to big savings over a year.

Step 8: Boost Your Income

Look for ways to make more money if you can. This could be asking for a raise, finding a part-time job, or doing freelance work. Extra income can help you reach your financial goals faster and give you more budget flexibility.

Step 9: Plan for Big Expenses

Think ahead about major expenses you might have during the year, like vacations, home repairs, or holiday shopping. Include these in your budget and start saving for them early. Planning ahead means you can enjoy these things without financial stress.

If you’re having trouble creating or sticking to your budget, consider talking to a financial advisor. They can give you personalized tips and help you make a budget that fits your situation and goals.

Conclusion

Budgeting your yearly income doesn’t have to be hard. By knowing your income, tracking your expenses, setting goals, and adjusting as needed, you can take control of your finances and work towards a brighter future. With a bit of planning and discipline, you can make your money work for you and achieve your financial dreams.

Send Us A Press Statement Advertise With Us Contact

And For More Nigerian News Visit GWG.NG