Business

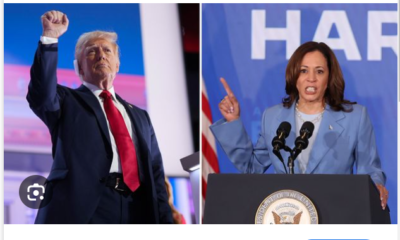

Bitcoin, Dollar Jump As Trump Wins US Election

Financial markets saw intense swings as traders responded to Donald Trump’s assured victory in the U.S. presidential race. By 9:00 AM GMT, the U.S. dollar had jumped significantly, showing a 1.25% increase in the U.S. Dollar Index and hitting a four-month high.

This climb in the dollar was largely driven by early wins for Republicans in key states like Georgia and Pennsylvania, which gave investors confidence in Trump’s economic policies.

With the possibility of a “Red Sweep”—where Republicans might control both the Senate and the House of Representatives—the dollar continued to gain strength. Analysts pointed to Trump’s tax cut plans and potential tariffs on imports as positive for the dollar, despite some concerns about rising inflation.

The dollar’s rise was especially noticeable against the Mexican peso and the Chinese yuan, with the peso hitting its highest level in over two years.

Meanwhile, Bitcoin reached a new record, soaring by as much as 9% to $75,389 before slightly falling below $74,000. This increase was attributed to Trump’s perceived favorability toward cryptocurrencies compared to his opponent, Kamala Harris. Bitcoin’s total market value surged, growing 7.15% over the past day to reach $1.45 trillion.

U.S. stock futures were also rising, with the Dow Jones Industrial Average futures gaining 956 points, or 2.2%, while the S&P 500 and Nasdaq futures rose by 1.9% and 1.7%, respectively.

Despite the optimistic market outlook, some analysts warned that inflation could lead the Federal Reserve to keep interest rates high, rather than lowering them as previously expected.

James Knightley, chief international economist at ING, commented that while tax cuts might uplift consumer and business sentiment briefly, Trump’s proposed tariffs and immigration policies could create economic challenges.

Analysts at Deutsche Bank agreed, noting that a Republican-led government under Trump would have substantial control over fiscal policies, which could result in a strong market response.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG