Business

Deep Deliberations For Emefiele Ahead Of Crunch MPC Meeting

By Emmanuel Aziken, Editor with Agency reports

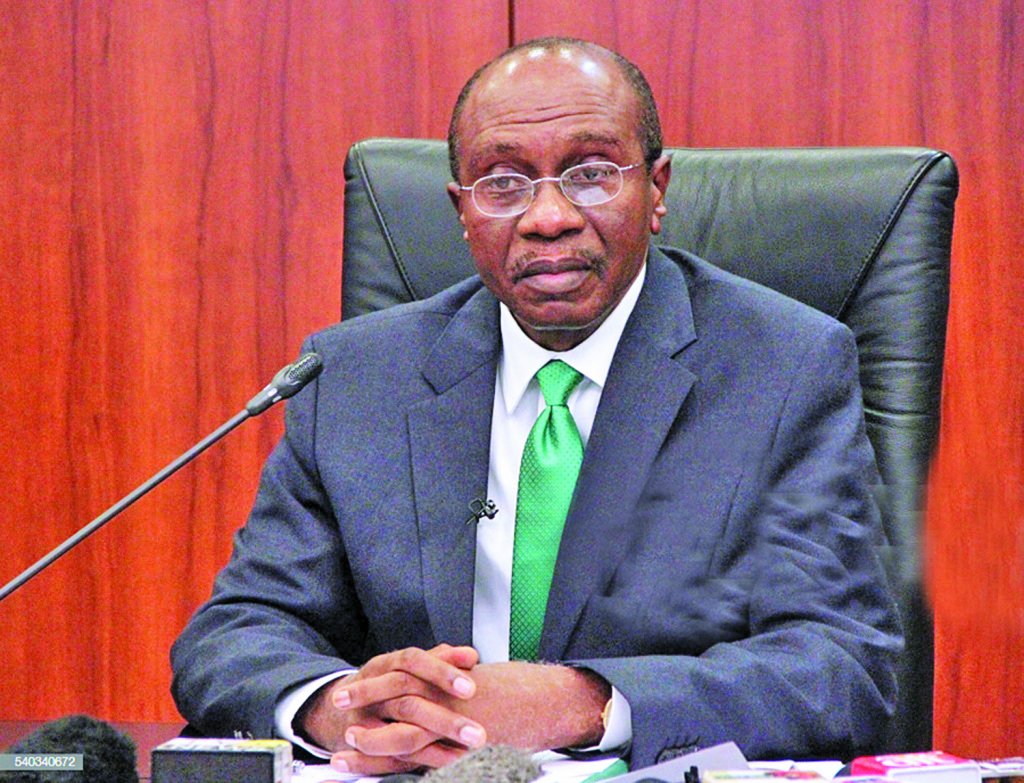

Nigeria’s monetary authorities are this weekend preparing for the crucial decision on the direction of the country’s monetary policies as Governor Godwin Emefiele weighs the consequences of Nigeria’s recent relapse to protectionism.

The first Monetary Policy Committee, MPC meeting since the effect of the controversial border closure began to bite sharply among Nigerians and on the West African coast comes up on November 25 and 26.

At the last meeting in September the effects of the country’s decision to lock its land borders against all trade were only beginning to appear.

Indeed, the September MPC communique had lauded the progressive management of inflation in the last quarter.

However, since then the border closure has translated into mixed blessings of sorts for the country. While it has generally been flayed for its dire effects on the country’s neighbours, the closure has meant mixed blessings of sorts for Nigerians.

Prices of many commodities which easily seeped through the borders before the closure have skyrocketed with much fears that inflation could now be turning into a serious threat.

Whatever is the response of the MPC would, however, have to be weighed against different parameters.

Farmers, particularly poultry farmers have been blessed with prices of eggs and old layers rising while inputs have remained relatively stable.

However, for consumers of poultry products and imported rice, prices have skyrocketed.

Against this background experts will be watching whether the CBN which has held the Monetary Policy Rate at 13.5% since March will adjust it. The MPR benchmarks the rate at which the apex bank lends money to the commercial banks and that also determines the rate at which banks pass off credit to their customers.

Speaking on the issue, the Director, Centre for Economic Policy Analysis and Research (CEPAR), University of Lagos, Prof. Ndubisi Nwokoma, urged the committee to use the MPR to stop the increasing direction of inflation occasioned by border closure.

“The Central Bank should do what it can to arrest the rising case of inflation that is occasioned by border closure.

“I will advise that the committee maintains the Monetary Policy Rate which is at 13.5 percent, or even go to 14 per cent if possible,’’ he told NAN.

According to him, the inflation is trending upward and it can get worse because of the minimum wage that is about to be implemented.

He urged the apex bank to arrest and maintain price stability.

Nwokoma said: “The primary function of the Central Bank is price stability; Monetary Policy Committee specifically, is to maintain price stability and they have been arresting that for some time now and it’s been coming down; now its trending up.

“I don’t think they will want to lower rate; they will rather maintain it, if not even increase it, because they cannot see inflation trending upward and you are now loosening interest rate.

“That may not be what anybody will expect. So, I think they will seek redress to find stability,’’ he said.

In the same vein, the Chief Operating Officer of CitiServe Limited, Mr Jubril Salaudeen, believes that the monetary policy rate would be maintained.

“I strongly believe that CBN Monetary Policy Rate will be maintained at 13.5 per cent.

“Maintaining the monetary policy rate at its present level is essential for better understanding of the momentum of growth before determining any possible modifications.

“ The border closure and associated changes to deposit and withdrawal of cash across the country have upset the system a bit.

“Also, this will help the country to tame inflationary pressures as headline inflation rose to 11.37 per cent,’’ he said.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG