Business

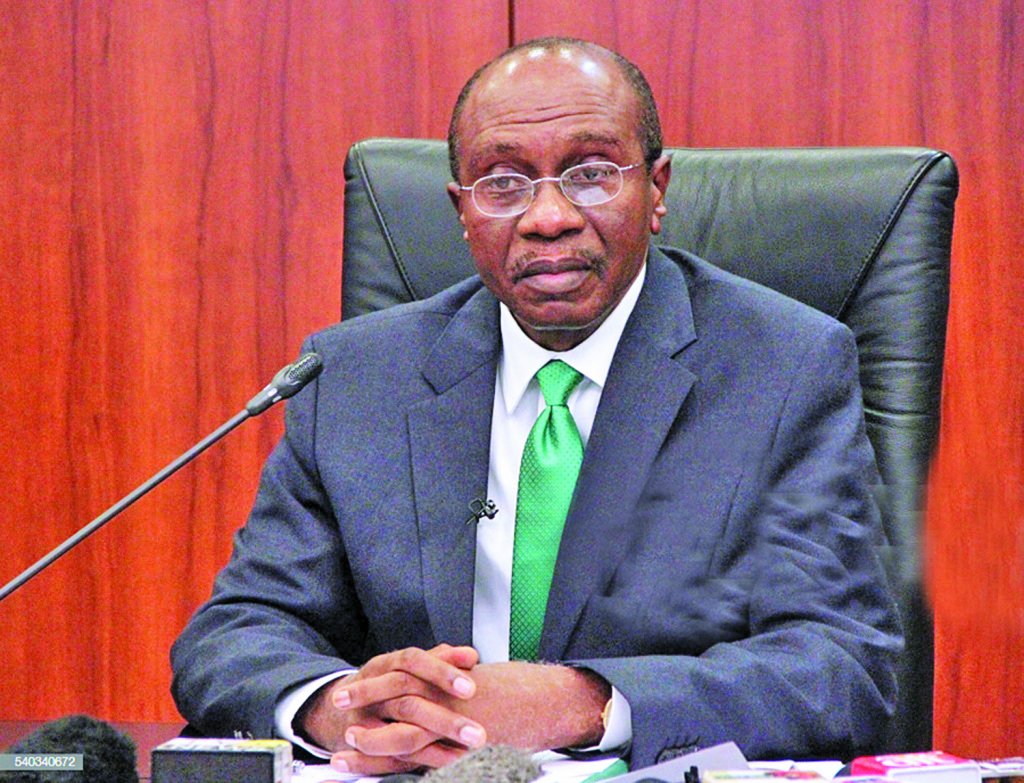

FDIs: Taking Emefiele In His Words

By Emmanuel Aziken

Governor Godwin Emefiele at the weekend assured foreign investors of the security of their investments in the country despite the challenging times the country is passing through in the face of the COVID-19 pandemic.

The reassurance remarkably follows prior weaknesses in the economic fundamentals that had made foreign investors to be skeptical of the Nigerian investment environment in the last few years.

Foreign Direct Investments under the Muhammadu Buhari administration progressively slipped from a peak of $1.4 billion in Q3 2016 to $314 million in Q1 2019. That low was at the time of political uncertainty that shadowed the General Election.

It has started picking up with uncertain steps but has now been seriously impacted by the COVID-19 menace.

At the centre of the challenge for many foreign investors are the dual problems of inconsistency in policy outlooks and investors’ questions on the CBN’s determination to continue the reported subsidy on the naira. Both factors combine to dim investors’ outlook on the prospects of quickly pulling out their funds as is required for any vibrant economy.

Nigeria’s apex bank according to reports spends as much as $12 billion per annum in sustaining the naira at its present value.

Many of the foreign investors believe that the naira is not sustainable and that sooner than later it would cave in and the government would have to abandon sustaining it at its present value to the dollar

Many of the foreign investors believe that the naira is not sustainable and that sooner than later it would cave in and the government would have to abandon sustaining it at its present value to the dollar.

“If it happens and the government is forced to dramatically devalue the naira to allow it reach its real value foreign investors would have their hands burnt and that is why some are very much afraid of Nigeria for now,” one source said.

However, for Governor Emefiele the sinking hole of subsidizing the naira is one that is apparently beyond his remit despite the acclaimed independence of the apex bank. Central to his challenge in managing the naira is the political environment that is coloured with the mockery by President Buhari’s political rivals that he promised to make the naira equivalent to the dollar!

Though that quotation is hard to come by, Emefiele even if he seeks to allow the naira to float would be hampered by Buhari’s natural inclination to state control under which he grew up as an oil minister and military head of state.

It is perhaps in that direction that the CBN rushed out the reassurance to the markets ahead of opening on Monday that foreign investments in the country remain safe.

Governor Emefiele was, however, sincere enough in his statement to inform as is evident to all that Nigeria has challenges in its dollar receipts. That challenge is evidenced by the lull in the oil market which has reached unprecedented lows.

It was as such significant that the statement also sent a message to local entrepreneurs to take opportunity of the situation on ground to boost non-oil enterprises towards redressing the challenges that face the economy from the vagaries of the international oil market.

It is significant that the CBN governor has frontally addressed the situation as it concerns the foreign investors underpinning his supplication with the 2015 experience when the country was faced with a similar situation of declining oil receipts.

At that time he said the country sustained its commitment to foreign investors saying that the apex bank would do the same at this time. That is reassuring enough.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG