National

Pandora Papers: Peter Obi Explains Why He Hid Companies

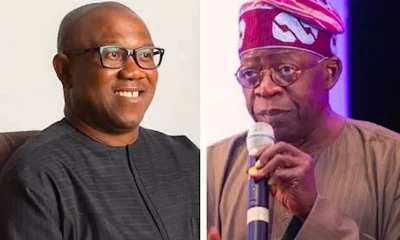

Reports have shown that a former governor of Anambra State, Peter Obi set up companies under false names in order to conceal his activities from the public and the government of Nigeria.

Premium Times, in partnership with the International Consortium of Investigative Journalists (ICIJ), a nonprofit newsroom and network of journalists based in Washington, D.C., published a report on Monday titled “The Pandora Papers”.

READ ALSO:Omokri Stokes Debate On Virtues Of Virgins As Wives

The report disclosed a global web of political power and secret offshore financial and business dealings that had been kept hidden for years.

According to the report, former governor Peter Obi is involved in a number of business ventures, including money laundering and the establishment of shell companies in order to avoid detection by Nigerian law enforcement authorities.

For example, he has several secret business dealings and relationships that he has kept close to his chest for years. “These are businesses he set up and operated clandestinely overseas, including in notorious tax and secrecy havens, in ways that were in violation of Nigerian laws,” according to the Pandora Paper Report.

The report also said that “the former governor admitted that he did not declare these companies and the funds and properties they hold in his asset declaration filings with the Code of Conduct Bureau, the Nigerian government agency that deals with issues of corruption, conflict of interest, and abuse of office by public servants.”

“He claimed he was completely unaware that the law required him to declare any assets or businesses he owned in partnership with his family members or anyone else. According to the report, Peter Obi established a company — named after his daughter — to serve as a front for his commercial activities.

According to the report, “the politician developed a desire to establish his first discreet company in the British Virgin Islands.” He named the company Gabriella Investments Limited after his daughter, who is the inspiration for the name.

The report explained that, in order to set up what has now become a convoluted business structure, Mr Obi first approached Access International, a secrecy enabler based in Monaco, France, who assisted him in incorporating an offshore entity in one of the world’s most notorious tax havens, which is known for providing conduits for wealthy and privileged corrupt political elites to hide stolen money in order to avoid the attention of tax authorities.” As a defence, Peter Obi explained to Premium Times that “the offshore entity serves as the holding company for the majority of his assets, and that the business structure he adopted was designed to allow him to avoid paying excessive tax.”

“I am confident that you, like me, would prefer not to pay inheritance tax if you can avoid it,” he added.

The investigation revealed that these offences “violate sections of the Fifth Schedule of the Constitution of the Federal Republic of Nigeria 1999, as amended,” according to the results of the investigation. Yet, in response to questions about the former Governor’s alleged shady dealings, he stated that he was “more concerned about his alumni network in the United Kingdom and the United States,” as well as his business and foreign creditors.

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG