Business

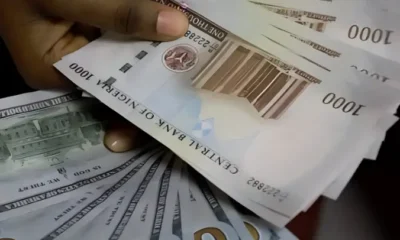

Naira Marginally Appreciates Against Dollar Amidst MPC Rate Hike

The naira appreciated marginally against the United States dollar to N1,609 on Wednesday at the official market from N1,615.94 recorded the previous day.

This indicates an increase of N6 or 0.37 per cent. The slight improvement came on the heels of series of foreign exchange guidelines issued by the Central Bank of Nigeria in recent weeks.

Meanwhile, the Monetary Policy Committee on Tuesday raised the Monetary Policy Rate, also known as benchmark interest rate, by 400 basis points to 22.75 percent on Tuesday from 18.75 per cent in July 2023.

It also adjusted the asymmetric corridor around the MPR to +100/-700 from +100/-300 basis points, raised the Cash Reserve Ratio from 32.5 per cent to 45.0 per cent, and retained the Liquidity Ratio at 30 per cent.

However, the expected impact of the rate hike has not yet reflected on the official foreign exchange as the naira depreciated by 2.04 percent after the dollar was quoted at N1,615.94 on Tuesday compared to N1,582.94 quoted on Monday at the Nigerian Autonomous Foreign Exchange Market, data from the FMDQ securities exchange indicated.

Government officials have consistently maintained that the naira is currently undervalued.

Data from FMDQ showed that the naira dropped to N1,615.94/dollar on Tuesday from N1,582.94 on Monday.

This represents an N30 or 2.0 per cent depreciation compared to the N1,582.94 recorded at the close of trading on Monday.

During spot trading on Wednesday, the intraday high was N1,660, depreciating from N1,778/$ on Tuesday and N1,805/$1 on Monday. But, the intraday low increased marginally to N1,401 from N1,300 on Tuesday and N1,301/$ on Monday.

However, the daily FX market turnover further declined to $119.14m from $154.16m recorded on Tuesday and $166.58m on Monday.

At the parallel market, there was no standard price for dollar sales, our correspondent gathered from currency operators.

A BDC operator, Malam Ibrahim, offering an explanation said the rates changed at least seven times before the close of trading activities.

“Currently, nobody can tell you the actual price because you can get up to seven different prices in a day and within minutes. The naira is just a pendulum right now, up and down.

“We are looking for buyers but majority of our customers are looking for dollar to sell and there is no buyer. So that is the problem,” he said.

During the day, the naira however traded between N1,300, N1,450 and N1,500 on Wednesday compared to N1,550 exchanged on Tuesday on the black market.

Another BDC operator confirmed the situation stating that the consistent raids by security operatives has reduced the willingness to trade.

Meanwhile, BDC operators had yet to receive their dollar allocation promised by the CBN as of 9pm on Wednesday night.

Although the reason is yet to be known, over 1300 BDCs have been listed for the allocation by the CBN.

The CBN in a circular on Tuesday promised to sell $20,000 to each BDC at a rate of N1,301/$.

The BDCs are allowed to sell to end-users at a margin not more than one percent above the purchase rate from CBN.

Source: Punch

Send Us A Press Statement Advertise With Us Contact Us

And For More Nigerian News Visit GWG.NG