News

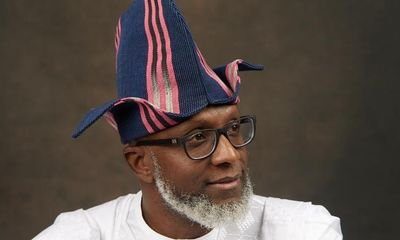

Nigeria Will Tax Google, Twitter For Profits Made In Nigeria – Osinbajo

Vice-President Yemi Osinbajo has disclosed that a legal framework that will enable the federal government to impose tax on global technology and digital firms with no physical establishment in the country, but with a significant economic presence, is underway.

The vice president made the disclosure when he met with a delegation of the Chartered Institute of Taxation of Nigeria (CITN).

The CITN delegates were led by Adesina Adedayo, the institute’s president, to the Presidential Villa in Abuja on Friday.

The federal government will not be raising tax rates at this time but will utilise the legal provisions of the finance act of 2019 to receive taxes from the tech firms, a statement by Laolu Akande, vice-president’s spokesman, on Sunday, quoted Osinbajo to have said.

He said although the social media companies and technology firms are not established in Nigeria, they have considerable economic presence in the country.

According to the statement, section 4 of the finance act 2019, provides that “the Minister (Finance) may by order (of the President) determine what constitutes the significant economic presence of a company other than a Nigerian company”.

“We have had severe economic downturns which of course implies that we may not be able to collect taxes with the aggressiveness that would ordinarily be expected,” he said.

“I think the most important thing is that we must widen our tax net so that more people who are eligible to pay tax are paying.

“We have also recently taken a step with respect to a lot of the technology companies that are not represented here but who do huge volumes of business here.

“The finance act has shown that we are very prepared to ensure that these big technology companies do not escape without paying their fair share of taxation in Nigeria. Many of them do incredible volumes here in Nigeria and in several other parts of the region.

“We have drawn up the regulations and we are prepared to go, and I think that we are at least in a good place to tap into some of the tax resources we can get from some of these companies.”

Akande quoted the finance act of 2019 which provides that a company will pay taxes if it “transmits, emits or receives signals, sounds, messages, images or data of any kind by cable, radio, electromagnetic systems, or any other electronic or wireless apparatus to Nigeria in respect of any activity, including electronic commerce, application store, high-frequency trading, electronic data storage, online adverts, participative network platform, online payments and so on, to the extent that the company has significant economic presence in Nigeria and profit can be attributable to such activity.”

READ ALSO: Twitter Ban: Falana Reacts To ECOWAS’ Court Decision, Says Too Late To Complain

Nigeria’s Security Woes Will End Soon – Osinbajo

Osinbajo noted that that federal government has no plans to raise taxes now, but added that some people argue that Nigeria’s tax rates are too low when compared to other countries.

He said: “So we have had to balance all of these issues because clearly, higher tax rates can be a disincentive to businesses and investments. In terms of domestic resource mobilization, we are trying to do the best we can given the present circumstances and I believe that there is room for improvement.”

Akande said the CITN president commended Osinbajo’s leadership in the implementation of key government interventions in the economy.

“The Nigerian Economic Sustainability Plan (NESP) and other measures implemented was a right response to the challenges posed by COVID-19 pandemic and were largely instrumental to creating buffers for the government at all levels in withstanding the pressures and waves created during the peak period and and the aftermath of COVID-19,” he said.

“It is important that we sustain measures already being implemented to improve tax collection at all levels.”

And For More Nigerian News Visit GWG.NG